If you’ve been an investor for a while, you’ve likely heard the phrase “picks and shovels” when referring to a company. This designation is given to a business that may not follow a trend directly. Instead, she is giving her clients the tools they need in their endeavors. When it comes to the artificial intelligence (AI) gold rush, there are a few companies that are shining.

While many can tell about Nvidia as a final example, Semiconductor manufacturing in Taiwan (NYSE: TSM) supplies the chips that go into Nvidia’s graphics processing units (GPUs). This notion that Taiwan Semi is akin to pickpockets in the gold rush is a good one, but it’s a familiar example. As a result, the stock has risen significantly this year.

However, most investors don’t care about past performance and want to know if there is more left in the tank for growth in Taiwan Semi shares. Let’s find out.

The chipmaker behind much of the innovative AI technology

Taiwan Semiconductor (or TSMC, as it’s often known) is in a unique position as a chip foundry. Because many companies don’t have the infrastructure to build chips, they outsource to TSMC. So a company like Nvidia or Apple designs a chip and then gives that design to TSMC to manufacture for them. This is an excellent position to be in, as Taiwan Semiconductor is a neutral party.

While TSMC makes Nvidia chips for its GPUs, it also makes chips for AMD. Additionally, with major cloud computing providers beginning to design their own chips as alternatives to GPUs — such as AlphabetTensor Processing Unit (TPU) — Taiwan’s semiconductor will benefit.

At the end of the day, Taiwan Semiconductor is a winner, no matter what form of compute a customer chooses to run AI workloads. Management also expects significant growth in this area.

It predicts AI-related revenue to grow at a 50% compound annual growth rate (CAGR) for the next five years. By then, it estimates that AI computing will account for about 20% of its total revenue. This is a big increase and is also in line with management’s comprehensive projection.

During the January 2022 investor conference, management guided for a revenue CAGR of 15% to 20% for “the next several years.” Management reiterated that guidance for 2024 and maintained that the level of growth is achievable.

A CAGR of 15% to 20% for a company the size of Taiwan Semiconductor is impressive, and that’s why investors are so excited about the stock. But there is one more catalyst that could be even bigger.

Apple’s latest announcement could be huge for TSMC

While Taiwan Semiconductor doesn’t name companies in the sales concentration section of its annual report, one customer accounted for 25% of the company’s revenue in 2023. Some might think it’s Nvidia, but that same customer also accounted for about a a quarter of TSMC’s revenue in 2021 and 2022, a time when Nvidia’s GPUs were not in demand.

Indeed, it can only be one company: Apple. Because TSMC is a major supplier of the chips that go into the iPhone, Apple is a massive customer.

Apple also had a massive announcement at its Worldwide Developers Conference last week: AI generative features will only be available on iPhone 15 or newer phones. This is huge because an estimated 90% of iPhones in the world are older than this generation, which could trigger a massive refresh cycle.

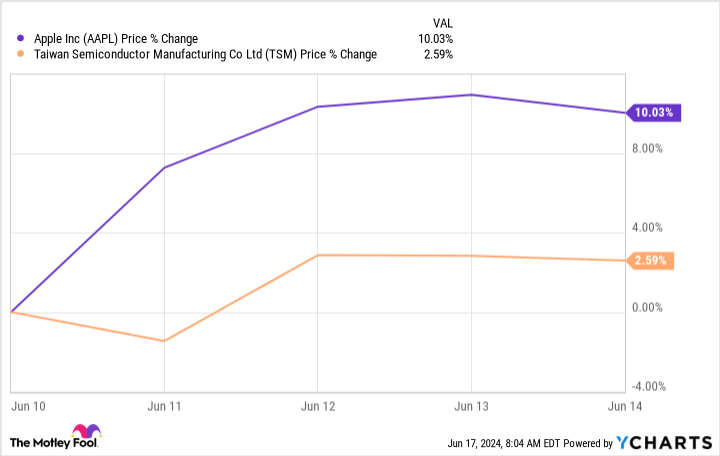

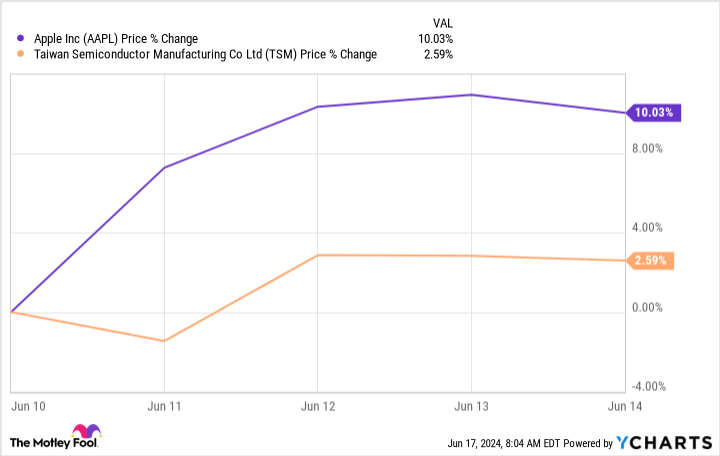

Because a quarter of Taiwan Semiconductor’s business is from Apple, this is big news for the company. Apple shares rose over 10% in the days following the announcement, but TSMC rose only about 2.5%.

This is an oversight from the market and could be a great opportunity for investors to reap the benefits of rising iPhone demand in an alternative way.

With massive demand for AI still to come and a possible upgrade cycle starting for iPhones, there’s still plenty of gas in Taiwan Semiconductor’s stock. I think it’s one of the best buys on the market right now and investors will thank themselves years later for buying it.

Should You Invest $1000 in Semiconductor Manufacturing in Taiwan Now?

Before you buy shares in Taiwan Semiconductor Manufacturing, consider this:

of Motley Fool Stock Advisor the team of analysts just identified what they believe they are Top 10 Stocks for investors to buy now… and Taiwan Semiconductor Manufacturing was not one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia I made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you would have $830,777!*

Stock advisor provides investors with an easy-to-follow plan for success, including instructions for building a portfolio, regular updates from analysts, and two new stock picks each month. of Stock advisor the service has more than quadrupled return of the S&P 500 since 2002*.

See 10 shares »

*Stock Advisor returns on June 10, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet and semiconductor manufacturing in Taiwan. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Apple, Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

Semiconductor manufacturing in Taiwan is the pick of the artificial intelligence (AI) gold rush. Are there more upsides? was originally published by The Motley Fool

#Semiconductor #manufacturing #Taiwan #pick #artificial #intelligence #gold #rush #upsides

Image Source : finance.yahoo.com